29+ Calculate my mortgage payment

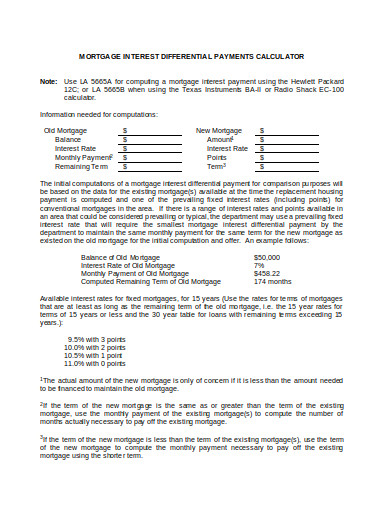

Some lenders can change an interest-only payment to a repayment mortgage without any further processing. If your monthly mortgage payment and other monthly debts exceed 43 of your gross monthly income you might have trouble repaying your loan if times get tight.

Handy Home Blog Calculating How Much You Can Afford To Spend On A Mortgage Payment Buying First Home Home Buying Tips Home Buying

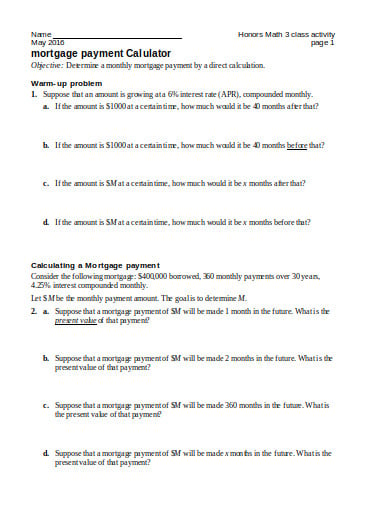

According to Figure 1 this means that type0 the default for the FV functionIf I wanted to deposit 1000 at the beginning of each year for 5 years the FV function in Excel allows me to calculate the result as FV45-10001 where type1Just remember that.

. First we calculate the monthly payment for each of your respective loans individually taking into account the loan amount interest rate loan term and prepayment. Determine the mortgage insurance rate. N the total number of payments.

Mortgage rates pulled back this week but economic uncertainty continues to keep price-struck buyers at bay. R the periodic interest rate. An example would be if you had 100000 in savings and used all of it to finance a 500000 property with a 2500 monthly mortgage payment when your net income is 3000 per month.

The IRS requests financial. Closing Costs Calculator. To calculate the percentage ROI for a cash purchase take the net profit or net gain on the investment and divide it by the original cost.

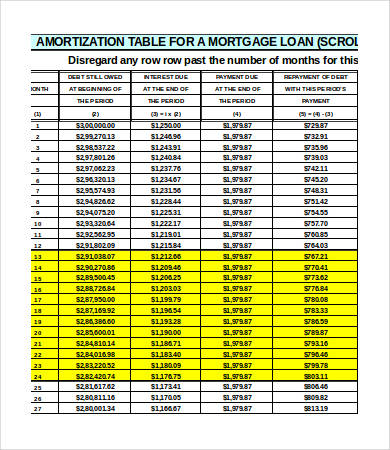

The easiest way to determine the rate is to use a table on a lenders website. Estimate your monthly loan repayments on a 100000 mortgage at 4 fixed interest with our amortization schedule over 15 and 30 years. When you take out a mortgage you agree to pay the principal and interest over the life of.

The interest charge for the second payment would be 16633 while 20329 will go toward the principal. Private mortgage insurance rates are typically 05 to 10 of the value of the mortgage. But vary just one payment by as much as one day and the initial schedule will not be precise.

Calculate your monthly UK remortgage payments quickly using this free online calculator. They offer a low origination fee about 1 of the loan the lowest interest rates. Youd need a mortgage refinance or to pay off the loan completely to stop paying MIP.

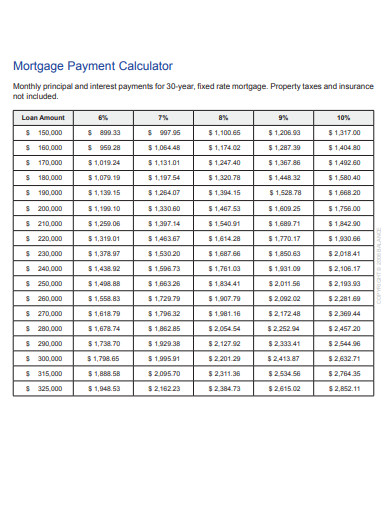

Your total interest on a 700000 mortgage. If you have a mortgage youll need to factor in your. At a 4 fixed interest rate your monthly mortgage payment on a 30-year mortgage might total a month while a 15-year might cost a month.

Mortgage rates starting at 5 APY. 1681276 for surprisingly efficient and user-friendly and free comparison of refinancing rates on both home and. Private mortgage insurance or PMI is a type of insurance typically required by the mortgage lender when the borrowers down payment on a home is less than 20 of the total cost of the home.

The above calculations consider the capital and interest portion of the mortgage payment but do not cover other. With each subsequent payment you pay more toward your balance. If you itemize your deductions on Schedule A Form 1040 you can deduct on line 5c state and local personal property taxes on motor vehicles.

Fannie Mae HomePath mortgage. For a biweekly payment it is divided by 26 while a monthly payment is divided by 12. To calculate mortgage interest start by multiplying your monthly payment by the total number of payments youll make.

Year Beginning balance Monthly payment. Real estate 40 cities that could be poised for a housing crisis. You can calculate stamp duty across the UK using the governments free online tool.

If you instead opt for a 15-year mortgage youll pay over the life of your loan or about half of the interest youd pay on a 30-year mortgage. When youre shopping for a mortgage the FHA loan programs mortgage insurance premiums may seem like a big downside especially since annual MIP often lasts for the life of the loan. Note These formulas assume that the deposits payments are made at the end of each compound period.

So with a 20 down payment on a 30-year mortgage and a 4 interest rate youd need to make at least 90000 a year before tax. 936 Home Mortgage Interest Deduction for more information. Ultimately how much you need to make depends on your down payment loan terms taxes and insurance.

On a 30-year mortgage with a 4 fixed interest rate youll pay over the life of your loan. Tips to lower your FHA mortgage insurance rate. If another party deposits in your account or transfers you more than one payment of 10000 or more within 12 months your bank must also report the transactions to the IRS.

By the time of the last payment 30 years later the breakdown would be 369 for principal. If a mortgage payment is due on March 1 is the interest charged for the month of March or is it for the previous month of February. Whenever a payment is paid the lender will calculate how much of the payment is allocated to interest using the loans current principal balance the days since the last payment and the fixed or current adjustable interest rate.

Can be as high as 2999 and will be lowered to the standard interest rate. Amortization means that at the beginning of your loan a big percentage of your payment is applied to interest. For a biweekly payment a 30-year term is multiplied by 26 resulting in 780 payments.

Then subtract the principal amount from that number to get your mortgage interest. Say you get approved for a 300000 loan. Be paid off over time.

Even if your deposits dont exceed the 10000 threshold your bank could still consider them worthy of reporting. 15-year mortgage rates. Monthly payments on a 600000 mortgage.

Low down payment no appraisal needed and no PMI January 23 2016 Fannie Maes mandatory waiting period after bankruptcy short sale pre-foreclosure is just 2. An MMM-Recommended Bonus as of August 2021. Calculate your mortgage payment.

For example if we include down payment on that 70000 annual salary your home budget shrinks to 275000 with a down payment of 10 percent if youre aiming to keep the 28 percent rule intact. Thats about two-thirds of what you borrowed in interest. PMI fees vary depending on the size of the down payment and the loan from around 03 percent to 115 percent of the original loan amount per year.

Amortization Tables 4 Free Word Excel Pdf Documents Download Free Premium Templates

4 Mortgage Payment Calculator Templates In Pdf Doc Free Premium Templates

Home Sellers Closing Costs Calculator Mls Mortgage Amortization Schedule Mortgage Estimator Mortgage Calculator

Bi Weekly Mortgage Calculator How Much Will You Save Mls Mortgage Mortgage Amortization Calculator Mortgage Payment Calculator Mortgage Loan Calculator

Down Payment Calculator Buying A House Mls Mortgage Free Mortgage Calculator Mortgage Payment Calculator House Down Payment

Calculate Mortgage Rates With The Mortgage Calculator Mortgage Amortization Calculator Mortgage Payment Calculator Mortgage Loan Calculator

How Much Home Can I Afford Mortgage Affordability Calculator Mortgage Payment Calculator Mortgage Free Mortgage Calculator

Refinance Mortgage Calculator Mls Mortgage Refinance Mortgage Home Refinance Free Mortgage Calculator

4 Mortgage Payment Calculator Templates In Pdf Doc Free Premium Templates

Reverse Mortgage Calculator Mls Mortgage Reverse Mortgage Mortgage Amortization Calculator Mortgage Payment Calculator

Printable Mortgage Calculator In Microsoft Excel Mortgage Loan Calculator Mortgage Amortization Calculator Refinancing Mortgage

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Home Equity Loan Mortgage Amortization Calculator

Auto Loan Calculator For Excel Car Loan Calculator Car Loans Loan Calculator

Mortgage Calculator With Escrow Excel Spreadsheet Mortgage Payment Calculator Mortgage Payment Mortgage

4 Mortgage Payment Calculator Templates In Pdf Doc Free Premium Templates

4 Mortgage Payment Calculator Templates In Pdf Doc Free Premium Templates

Financial Calculator Financial Calculator Calculator Calculator Design